In the world of business analysis, managing risk is a crucial responsibility. As a Business Analyst (BA), your role often involves identifying, assessing, and mitigating risks that could impact the success of a project. Effective risk management not only helps in delivering projects on time and within budget but also ensures that the project meets its objectives and adds value to the organization. This introductory blog post explores the fundamentals of risk management from a BA’s perspective, providing insights into why it matters and how to approach it.

What is Risk Management?

Risk management is the process of identifying, analyzing, and responding to risks that could affect a project’s objectives. Risks are potential events or conditions that, if they occur, may have a positive or negative impact on the project. While positive risks (opportunities) can lead to benefits, negative risks (threats) can cause delays, increased costs, or even project failure.

Key Steps in Risk Management:

- Risk Identification: Recognizing potential risks that could impact the project.

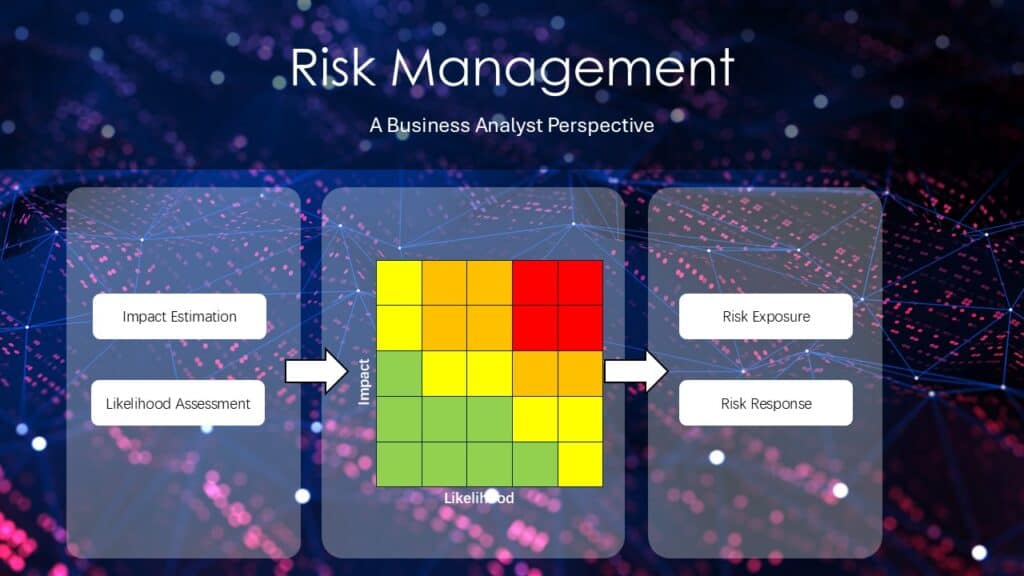

- Risk Analysis: Assessing the likelihood and impact of each risk.

- Risk Prioritization: Ranking risks based on their severity and the potential impact on the project.

- Risk Response Planning: Developing strategies to address each risk, whether by avoiding, mitigating, transferring, or accepting it.

- Risk Monitoring and Control: Continuously tracking identified risks, reassessing them, and identifying new risks as the project progresses.

Why Risk Management Matters for Business Analysts

For BAs, risk management is integral to the success of any project. By proactively identifying and addressing risks, BAs can help prevent issues that could derail the project, ensuring smoother execution and better outcomes.

1. Ensuring Project Success:

- Effective risk management helps in avoiding or mitigating potential problems before they escalate. This proactive approach increases the likelihood of delivering the project on time, within budget, and according to scope.

2. Aligning with Business Objectives:

- Risk management ensures that the project remains aligned with business objectives by addressing risks that could compromise the project’s value or strategic goals.

3. Building Stakeholder Confidence:

- A well-managed project inspires confidence among stakeholders. By demonstrating that risks are being managed effectively, BAs can build trust and maintain stakeholder support throughout the project lifecycle.

4. Enhancing Decision-Making:

- Risk management provides valuable insights that inform decision-making. Understanding the risks associated with different options allows BAs and project teams to make informed choices that balance opportunity and risk.

Key Risk Management Techniques for Business Analysts

To manage risk effectively, BAs should be familiar with several key techniques and tools:

1. Risk Workshops and Brainstorming:

- Facilitating workshops or brainstorming sessions with stakeholders and team members is a powerful way to identify risks. Engaging diverse perspectives ensures that all potential risks are considered.

2. SWOT Analysis:

- SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis is a strategic tool that helps in identifying internal and external risks. It’s particularly useful for aligning risk management with business objectives.

3. Risk Registers:

- A risk register is a document that lists all identified risks, along with their analysis, prioritization, and response plans. Keeping a well-maintained risk register ensures that risks are tracked and managed throughout the project.

4. Probability and Impact Matrix:

- This tool helps in prioritizing risks by evaluating their likelihood of occurrence and potential impact on the project. It enables BAs to focus on high-priority risks that require immediate attention.

5. Risk Response Strategies:

- Depending on the nature of the risk, different response strategies can be employed:

- Avoidance: Changing the project plan to eliminate the risk.

- Mitigation: Reducing the likelihood or impact of the risk.

- Transfer: Shifting the risk to a third party, such as through insurance or outsourcing.

- Acceptance: Acknowledging the risk and preparing to deal with its impact if it occurs.

Conclusion: The Business Analyst’s Role in Risk Management

Risk management is a critical skill for Business Analysts, enabling them to contribute to the successful delivery of projects. By systematically identifying, analyzing, and responding to risks, BAs can help ensure that projects achieve their objectives and deliver value to the organization.

As you continue to develop your skills as a BA, mastering risk management will empower you to navigate the uncertainties inherent in any project. With the right approach, you can turn risks into opportunities and steer your projects toward success.